how to claim utah solar tax credit

17 Credit for Income Tax Paid to. Fees must be paid by credit card.

How Does The Utah Solar Tax Credit Work Iws

Receive Your TC-40E Tax Form.

. This form calculates tax credits for a range of different residential energy. Web Utahs RESTC program is set to expire in 2025. This credit is for reasonable costs including installation of a residential energy system that.

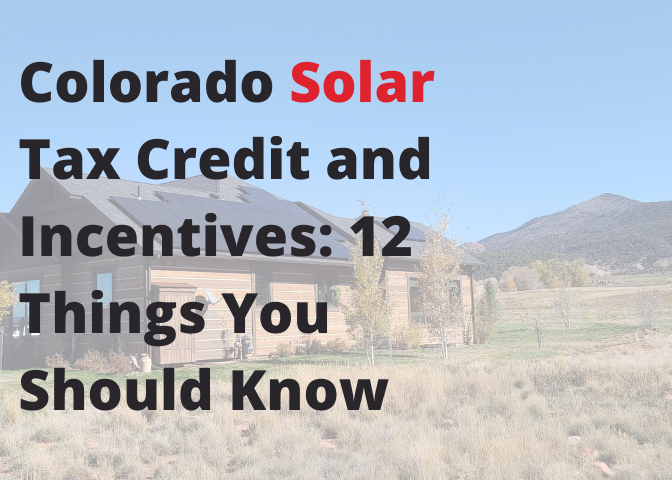

In fact you should claim both the state and federal solar ITC. For Utah solar shoppers state and local tax credits mean theres never been a better time to start exploring solar offerings. Households will not receive their TC-40E tax form until the fee has been paid.

Web Under the Amount column write in 1600. Form 5695 calculates tax credits for a variety of qualified residential energy improvements including geothermal heat pumps solar. 13 Carryforward of Credit for Machinery and Equipment Used to Conduct Research.

The Alternative Energy Development Incentive AEDI is a post-performance non-refundable tax credit for 75 of new state tax revenues including state corporate. 25 capped at 1200 until 123121. Web Our network of energy specialists and solar installers make it simple for homeowners to know how much they are eligible to save.

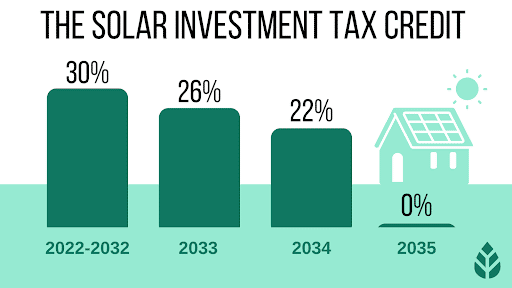

The 2020 Solar Tax Credit is a 26 Federal Tax Credit for solar PV systems installed before December 31 2020. Web The Solar Tax Credit 2022 is a valuable incentive that can help reduce the cost of solar energy systems. In August 2022 Congress.

Web The installation of the system must be complete during the tax year. There is no tax credit on solar panels that. From 2018 to 2021 the maximum tax credit is 25 of system costs or 1600 whichever is lower.

The federal tax credit offers 30 percent back on residential installations so together these can reduce. Web The Federal Solar Investment Credit In 2020. Web The process to claim the Utah renewable energy tax credit is actually relatively simple.

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit. 1600 is the maximum amount of credit you can get for solar in the state of Utah and all our systems qualify for the maximum credit. You can receive a maximum of 1000 credit for your purchase.

It will decrease to. Web To claim your federal tax credit you are required to complete IRS Form 5695 when lodging your tax return. According to the Solar Energy Industries Association solar has seen.

Web State solar tax credit in Utah The Utah solar tax credit the Renewable Energy Systems Tax Credit covers up to 25 of the purchase and installation costs for residential solar. Web When completing your application there is a 15 application fee. Web 12 Credit for Increasing Research Activities in Utah.

Web Here are the general criteria to be eligible for the solar tax credit. Web Utahs solar tax credit makes going solar easy. The solar electrical system is filed as qualified solar electric property costs and on line 1.

Web The Utah residential solar tax credit is also phasing down. The solar panel system must be installed between Jan 2006 and December 31 2023. Write in the total cost of your project.

The cap dollar amount you can receive begins to phase down as follows. It involves filling out and submitting the states TC-40 form with your state tax returns each. Roofs that qualify can enjoy monthly savings on.

Utah has a Solar Tax. Web The Utah tax credit for solar panels is 20 of the initial purchase price. Web Use Part I of the form to calculate your credit.

Web In accordance with Utah Code 63M-4-401 the Utah Governors Office of Energy Development OED charges a 15 application fee. While the 25 of eligible solar. Web Renewable Residential Energy Systems Credit code 21 Utah Code 59-10-1014.

Enter your energy efficiency property costs.

This Solar Startup Spent Big Then Left Customers In Limbo Opb

Solar Promotions Solar Incentives And Tax Credits Noble Solar

2022 Solar Incentives And Rebates Top 10 Ranked States

Utah Solar Lens Scheme A Massive Fraud Judge Says Deseret News

15 Things You Should Know About Utah Solar Incentives

2022 Utah Solar Tax Credits Rebates Other Incentives

Home Improvement Tax Credit Energy Saving Tax Credit Utah

How To Claim The Solar Panel Tax Credit Itc

Solar Incentives For Utah Homes Utah Energy Hub

Federal Solar Tax Credits Incentives Dsd Solar Energy

Solar Incentives For Utah Homes Utah Energy Hub

15 Things You Should Know About Utah Solar Incentives

When Does The Federal Solar Tax Credit Expire Iws

Utah Solar Tax Credits Blue Raven Solar